Market Reports

February 2026 Sarasota/Manatee Market Report

January 2026 Sarasota/Manatee Market Report

Broker Brink’s December 2025 Market Report

Broker Brink’s December 2025 Luxury Market Report

Broker Brink’s November 2025 Luxury Market Report

Broker Brink’s October 2025 Market Report

Broker Brink’s August 2025 Market Report

Broker Brink’s July 2025 Market Report

Broker Brink’s February 2025 Market Report

Broker Brink’s February 2025 Market Report

Broker Brink’s January 2025 Market Report

Broker Brink’s 2024 Year-End Market Report

Broker Brink’s Sarasota Market Report for December

Broker Brink’s Sarasota Market Report for November

Broker Brink’s Sarasota Market Report for October

Broker Brink’s October Report

Broker Brink’s September Report

Broker Brink’s September Luxury Market Report

Broker Brink’s August Report

Broker Brink’s July Report

Watch John’s Video Review – Click Here

Broker Brink’s July Luxury Market Report

Broker Brink’s June Report

Broker Brink’s May Report

Broker Brink’s April Report

Broker Brink’s March Report

Broker Brink’s February Report

Broker Brink’s January Report

Broker Brink’s December Report

Broker Brink’s November Report

Broker Brink’s October Report

Broker Brink’s September Report

Broker Brink’s August Report

Broker Brink’s July Report

Broker Brink’s June Report

Broker Brink’s April Report

People ask me a lot of technical questions. Are we heading into a recession? How will a recession effect residential real estate? How is inflation of the costs of goods effecting the real estate market? How has the quick rise in mortgage interest rates effected residential real estate? My answer is the “Butterfly Effect”. If you are a home buyer that is seeking financing, your purchasing power is much lower than it was about a year ago. But if you are a cash buyer, it’s more about how your equity positions are faring in the down stock market. That’s why it is important for your Realtor to know if you need a mortgage or if you are paying cash for your next home purchase.

Broker Brink’s March Report

Real Estate is VERY LOCALIZED…down to the street in any given neighborhood. The real estate market in Arizona isn’t the same as it is in Tennessee or Connecticut. The real estate market in Tallahassee, Florida is different than it is in Sarasota,

Florida. The real estate market in Sarasota is different that it is on Longboat Key Florida and the Longboat Key sales statistics vary from neighborhood to neighborhood and street to street. Real estate prices may be declining in your region of the U.S., your home state, city and neighborhood. However, that doesn’t mean that more popular cities like Sarasota have the same real estate trends.

Broker Brink’s February Report

After sorting through the past 4 years statistics from the Realtor Association of Sarasota and Manatee (RASM), I find it to be important to look back beyond the pandemic years because statistics show that when the recent pandemic struck, sales practically stopped and then just a few months later, Florida became the fastest growing state in the United States. Therefore, 2020 was an anomaly of sorts and shouldn’t be used as a valid comparable year. Whereas 2020 was an “anomaly”, 2021 became an “aberration” as Sarasota’s real estate sales were fueled by a fear of missing out (FOMO). Seems that everyone wanted to be where out-door living was the best. Similarly, recreational vehicles (RV’s) and boat sales were also off the charts.

See The Full Report

Broker Brink’s January Report

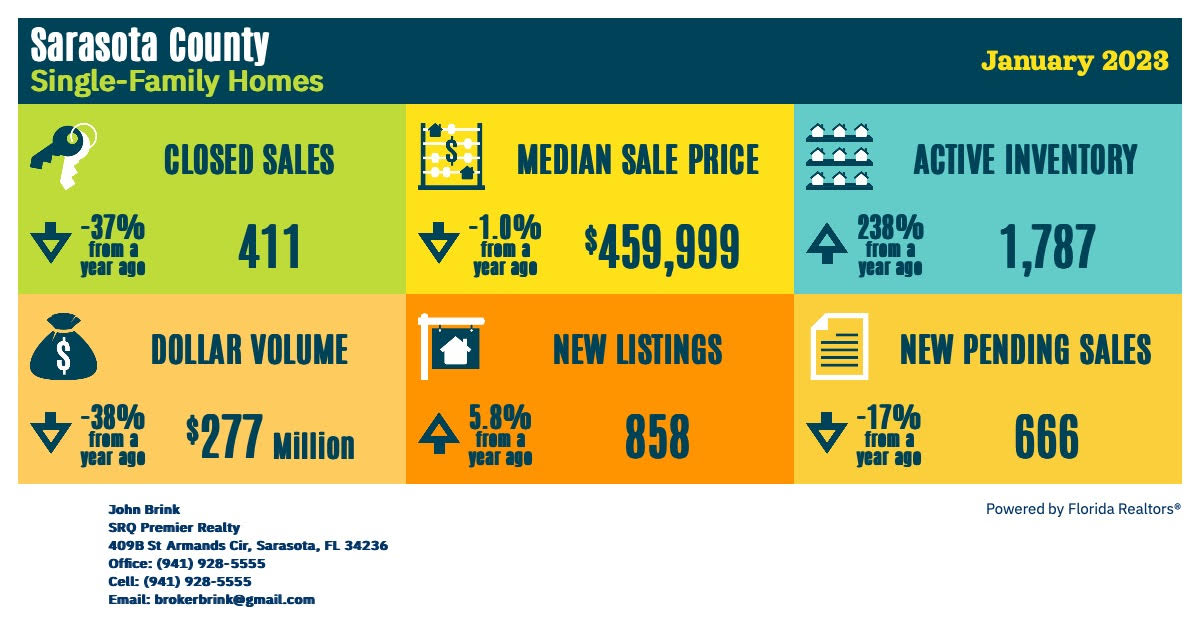

In an effort to slow down an overheated real estate market, the Fed quickly doubled interest rates at a historically faster pace than ever seen in the history of the United States. Fast forward just 12 months to December of 2022 and the U.S. housing market was facing an average 30 year fixed mortgage rate of nearly 6.4%. The impact on affordability for home buyers seeking financing was a nearly 50% payment increase.

Therefore, it should come as no surprise then that we had significantly fewer homes go under contract in December 2022 than a year ago, in December 2021.

Closed sales of existing Florida single family homes in December were down over 36% while over in the townhouse and condo category, closings were down 40%.

New listings continue to be constrained by high mortgage rates because those that have a historically low mortgage rate do not want to lose the more affordable house payment at 3% to buy a home with a 6% mortgage rate. Plus Americans have a general sense of economic uncertainty. Therefore, new property listings coming onto the market continue to fall off at a greater rate. This has created limited options for buyers, of course, but in doing so, they’re also keeping the ratio of sellers to buyers from falling at a more rapid clip, which is keeping inventory growth modest and prices stable.

We see cash buyers sitting on the sidelines because their stock portfolios are down. They don’t want to “sell low” to buy what they perceive to be “buying higher” priced real estate prices. This dichotomy has created a stalemate between buyers and sellers. Fewer sellers are motivated to buy and there are fewer buyers interested in buying. Very odd times. For now. Eventually, buyers will not wait any longer to buy a home in Sarasota and the market will return.

Some of our markets here in Sarasota Count now have inventories that are close to pre-pandemic levels, whereas others are seeing modest increase due to homes staying longer on the market. And in some markets, you’ll see a stark difference in this trend from zip code to zip code.

So, home sellers and buyers be sure to take advantage of working with a knowledgeable, skilled Realtor to help you. The SRQ Premier Realty Team is staying on top of the market and helping customers achieve their homeownership dreams.

John Brink, Owner-Broker

SRQ Premier Realty